Cloned Law Firms: How to Avoid Being Their Next Target

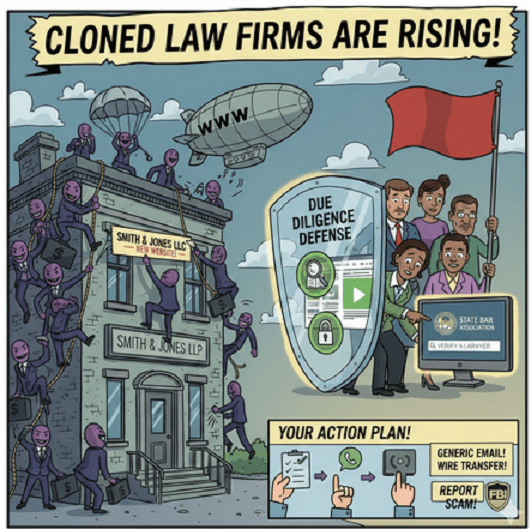

Identity theft has evolved to target professional services, with “cloned law firms” becoming a sophisticated and dangerous scam. These fraudulent entities steal the name, reputation, and sometimes even the physical address of a legitimate law firm to deceive potential clients, making them believe they are dealing with a trustworthy, licensed practice. The ultimate goal of these scammers is to steal your money, personal data, or both.

Understanding how these clone firms operate and knowing the red flags is your first and best defense.

What is a Cloned Law Firm?

A cloned law firm is a scam operation that takes on the identity of an authorized, genuine law firm. The fraudsters set up nearly identical online presence, often with a website, email domain, or social media profile that closely mimics the real one.

They may use the genuine firm’s name and logos.

They often lift the names of real, licensed attorneys from the legitimate firm.

The fraudulent website will frequently list a phone number or email address that does not belong to the authentic firm, routing calls or messages to the scammers.

By masquerading as a reputable entity, they gain the trust needed to pressure victims into paying high upfront fees, sharing sensitive information, or wiring funds for non-existent legal services.

How to Spot the Red Flags of a Clone Firm

Scammers rely on urgency and the expectation of a quick solution to prevent you from doing your due diligence. Slow down and check for these warning signs:

1. Suspicious Contact Information

Mismatched Details: Check the phone number and physical address listed on their website against an independent, verified source like your State Bar Association website or a trusted legal directory. Fraudulent sites often have a very similar web address (e.g., adding a hyphen or using a different domain extension like

.netinstead of.com).Generic Email: A legitimate law firm will almost always use an agency-specific email address (e.g., johnsmith@firmname.com), not a generic one like johnsmith@gmail.com.

2. High-Pressure Tactics and Unclear Fees

Urgency to Pay: Be highly suspicious if the firm pressures you to sign documents or pay a large fee immediately, especially if they request payment via wire transfer, cash, or an encrypted service without a clear, written agreement.

“Too Good to Be True” Promises: Legitimate attorneys cannot guarantee specific outcomes. Be wary of any firm that promises a guaranteed win or an absurdly low fee far below market norms.

3. Lack of Verifiable Presence

Refusal to Meet: If the firm insists on handling everything via email or phone and is hesitant or outright refuses to meet face-to-face, this is a significant red flag.

New Online Footprint: An established, legitimate firm should have an extensive online presence, including reviews, news mentions, and a professional website that has been active for some time. A very recently created website could indicate a scam.

Social Media/Messaging Contact: The FBI has recently warned of scammers impersonating law firms on social media and encrypted messaging apps. Do not engage with or send money to a firm that contacts you out of the blue via platforms like WhatsApp or Instagram for legal matters.

Your Defense Strategy: Verify, Verify, Verify

Protect yourself by implementing a strict verification protocol before you share any personal information or pay any money.

1. Check the Bar Association Status: Every licensed attorney in the U.S. is registered with their state’s State Bar Association. Use their official “Look Up a Lawyer” feature to:

Verify the attorney’s active license status.

Confirm the contact information listed on the Bar’s site is an exact match for the firm that contacted you.

Review any public disciplinary actions taken against them.

Crucial Step: Once you have the Bar’s verified phone number for the real firm, use that number to call them and confirm the person/matter you are dealing with is authentic.

2. Conduct Independent Research:

Search reputable online review platforms for testimonials and check the age of the reviews. Be suspicious of profiles with a very high volume of generic or fake-sounding reviews.

3. Scrutinize Financial Transactions:

Always verbally confirm wire instructions using a verified phone number you obtained independently—never use the number or instructions provided in an email, as this is a common tactic for financial fraud.

Be cautious of requests to transfer a significant amount of money for a limited amount of work.

If you suspect you’ve been targeted by a cloned law firm or a legal scam, stop all communication immediately. Gather all evidence and report the incident to the Federal Trade Commission (FTC) and the FBI’s Internet Crime Complaint Center (IC3).

Awareness is your strongest defense.

Contact us if you’d like more information on how cyber intelligence can help you locate scammers.

Please share this guide with friends and colleagues.